Saudi cannot be pumping crude oil forever as in

the distance future it will be pump more water than oil . This will not be

known the outside world because it maybe happening already and must be also a

reason for Aramco IPO.

Saudis lose US clout over oil price war

How does OPEC work?

OPEC (Organization

of the Petroleum Exporting Countries) is a consortium of thirteen countries,

headquartered in Vienna. Together, these countries account for about 40% of oil

production and more than 70% of world's proven oil reserves. For the past four

decades OPEC has had a wide range of influence on the oil sector, and thus on

the energy scene of the world. Simply put, OPEC is a cartel whose goal, since

its creation in 1960, has been to coordinate oil

prices in order to

ensure that oil producers received a steady stream of income. The mechanism

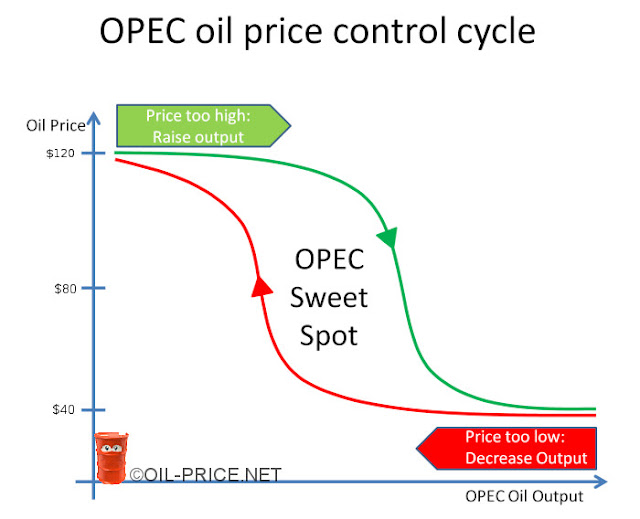

used by OPEC to control oil prices has been fairly straightforward; in

technical parlance it's a "hysteresis cycle", the same logic used by

a thermostat to control room temperature.

That is, if oil prices climb too high,

OPEC decides to sell a little bit more of oil in the open market so that the oil prices go down. This

is to avoid slowing first-world economies which would cause them to import less

oil. In other words, it takes the sting off its tail.

On the other hand, if oil prices fall too low,

OPEC reduces oil production so that oil prices spurt. With cut in supplies,

demand rises, after all. This way OPEC wrestles to keep oil prices high enough

to maximize profits. This hysteresis cycle started in the 70s itself when

reduction in oil production by the cartel led to immediate spike in oil prices.

In the eighties, OPEC started to set production targets to streamline the oil

price. In April 2001, OPEC reduced production by one million barrels, whose

effect as oil price increase was felt in the US, almost immediately. And, in

November 2006, it reduced production by 1.7 million barrels so as not to sledge

off the prices below the $50 per barrel mark. You see, the cartel had clout.

Now the scene moves to Saudi Arabia. The

kingdom being the largest producer (and exporter of oil) of OPEC, has become

the de-facto leader that few OPEC members dared oppose. During its first 54

year history, this mechanism worked great for OPEC, so why upset the apple

cart, opined the rest of the OPEC members. After all, the said mechanism

guaranteed a steady oil supply which, in turn, fuelled economic exchanges and

progress during the last half-century with an unprecedented increase in

prosperity worldwide.

Meanwhile thanks to new unconventional

methods, the American oil revolution was well underway and when in 2014 the US

passed Saudi Arabia as the first oil producer, Saudi Arabia, naturally, did not

like it. Clearly, it was used to everyone bowing to its tune. And so Saudi

Arabia decided to deal with US oil producers like the dictatorship usually

deals with its opponents: a public beheading for everyone to see. Unexpected to

everyone, the Saudis forced OPEC to increase production. It calculated that oil

prices would plummet and the US producers would be priced out of the market. The

logic was sound as fracking remains an expensive

process. This move from Saudi Arabia was, of course, historical.

No-one could have predicted nor anticipated. Not even Warren Buffett, usually right, but who

recently admitted of his mistake in investing in Conoco Phillips because of the

whole "peak oil" thing.

And, here's the rub, it worked. The

string of bankruptcies which ensued rivalled the size of the telecom bust.

Close to 70 oil and gas companies in the US filed for bankruptcy in the US so

far, with more to come. The scheme set in motion by Saudi Arabia was gaining

momentum.

Saudi Arabia pays the price for its actions

What Saudi Arabia thought of as a fool

proof plan quickly fell on its face. Yes, history will remember Saudi Arabia's actions as very

ill-planned indeed,

because in the matter of months following did happen:

1.

Saudi Arabia lost its grip on OPEC

2.

OPEC lost grip on oil prices

3.

Riyadh lost its most precious political

ally, the US oil industry

4.

US came clean on its relations with the

Saudi Kingdom, lifting the veil of secrecy

5.

Western democracies took note of Saudi

Arabia's increasing arrogance and now perceive Saudi Arabia in a negative light

6.

Saudi Arabia is on track to run out of

cash with no plan to survive low oil prices

Now, for the details.

The day OPEC lost grip on oil prices

Respectable leaders lead by example and

by breaking the golden rule of 'supply control' and by demanding others to

obey, 'leader' Saudi Arabia not only harmed other OPEC member countries, but

also lost all its credibility. And, reputation is one that is difficult to

salvage once lost. Saudi Arabia did what it did, but the effect was felt by

all. Breaking the rules of OPEC caused extreme hardships for other OPEC

members. For example, Venezuela and Nigeria's oil payments contribute more than

90 percent of their total revenue from exports. Now, after Saudi's ill timed

move, both countries are not only crumbling under massive revenue loss because

of low oil prices but are also on the brink of famine and civil war.

Ever since then, OPEC hasn't been able

to act in a cohesive coordinated way. So much so, OPEC meetings nowadays beget

mayhem as members don't respect quotas any longer and are just happy to 'get

something' for their oil. OPEC's clout has crumbled.

The cartel has lost the cohesion that once made it strong.

SA lost key political allies

Evidently, harming the American Oil revolution cost Saudi Arabia support from US oil

lobby. For decades, the Saudis and the US oil industry was a match made in

heaven. It was a honeymoon phase all along. Generous oil contracts were handed

to US oil companies to develop the Kingdom's vast oil resources. Saudi Arabia

hired lobbyists to curry favour in the political arena too. After all, US oil

companies are political heavy weights. Understandably many past US presidents

from both parties had dubbed Saudis a key ally in the region.

However, the numerous oil bankruptcies

in the US built resentment throughout the US oil industry. It turned out

harming the US oil industry to be was an ill-fated political move by Saudi

Arabia which lost its most influential ally in Washington. Also, it's an

election year in the US and politicians, both Republicans and Democrats, do not

want to be seen courting Saudi Arabia.

Take the case in point: Republican front

runner Donald Trump has been an outspoken critic of Islamic fundamentalism and

Saudi Arabia. Trump even made the declaration that he would stop purchasing oil

from Saudi Arabia if it did not provide troops to fight ISIS. And, he had the

choicest expletives for Prince Alwaleed Talal nicknaming him as "the dopey

Prince". Let's keep in mind that these apparently candid retorts and all

statements on the campaign trail are indeed carefully crafted by image

consultants; in the case aforementioned this is meant to achieve the following

end-goals:

§ Being outspoken against Islam gathered huge popular support

at a time when acts of terror like the Orlando nightclub shooting are on the

rise. Any politician, in a democracy, needs votes to get elected first and

foremost.

§ Denouncing Saudi donations to US politicians loud and clear

sends a loud and clear message to Riyadh that its days of Washington coziness

are over.

§ It sets the context of openness and transparency for

discourse, where freedom of speech is not muffled by the fear of offending a

religious group.

This is a definite departure from the

Republican's previous attitude towards Saudi Arabia. The Bush family's snugness

to the Saudi regime has been a thorn in the side of Republicans since 9/11 and

a detached outsider such as Trump brings a clean slate, signalling a clear

break with previous allegiances.

Sadly on the Democrat side, much energy

is spent on tiptoeing around the issue in an effort to court Islamic voters, in

a manner identical to Europe's socialist parties, at the expense of other

minorities. This betrayal of values has also been such a thorn in the side of

the Democrats that Hillary Clinton broke the party line and joined Donald Trump

in criticizing Saudi Arabia for funding terror. Expect political one-upmanship

all the way to election day in denouncing Saudi funding - which ironically both

parties have gladly accepted for years.

It will never be the same in Washington

for Saudi Arabia, ever again.

Still, until the election, Washington

had to do something and it did. It turned its back on the Kingdom by

re-kindling relations with Iran, Saudi Arabia's arch enemy cum rival. Sanctions

on Iranian oil were lifted officially in January and a nuclear deal was inked

last summer. As a result, Iran has become a key player in OPEC's stalemate.

Not stopping there, the US also did just

what Saudi Arabia feared the most: it started a motion to open its previously

secret dealings with Saudi Arabia to public scrutiny.

Lifting the veil of secrecy

Secrecy chapter between the US and

Riyadh has been a long time affair. During the 1973 oil crisis, Saudi Arabia

forced OPEC members to cut oil supplies to the US in retaliation for its

support of Israel in the Yom Kippur war. The oil prices went up, as did

inflation and OPEC realized its power. So much so, the then President Nixon

sent in Henry Kissinger, the secretary of State to cut a deal. With the

assistance of US Treasury Secretary William Simon, a deal was made with the

Saudis: they would buy US debt (bonds) with petrodollars to finance consumer

debt and trade deficit of the US. Of course, there was a catch. The amount of

US debt owned by Saudi Arabia would never be made public but rather published

as a bundled figure for Middle-Eastern state. This way Saudi Arabia's influence

would remain concealed from public scrutiny. By 1974, the petrodollar was in

rage with many oil producing countries wanting a way in. Come 1975, all the

OPEC countries agreed to price oil in dollars. The petrodollar was born, key

contributor to the American economic hegemony.

This historical secret agreement worked

great for both the US and Saudi Arabia. Neatly, the US was able to outspend

Russia throughout the eighties while Saudi Arabia funnelled Islamic fighters

including Osama bin laden to oppose Russia in Afghanistan. By 1991 the USSR

which could not keep up with US spending collapsed. The cold war was over.

This agreement was kept secret for over

40 years. This is the key to Saudi Arabian foreign policy: to cut secret deals

with heads of states, away from the populace. Secrecy is the key for Saudi

Arabia. That is, until now.

The whole thing came to a crescendo as

it was made public thanks to the US freedom-of-information act. Well, this

release of information was "helped" because US/Saudi relations were

deteriorating rapidly. Earlier, a bill went to congress Justice Against

Sponsors of Terrorism Act (JASTA), that will, if passed, allow the families

affected by the 9/11 terrorist acts to sue the Saudi Government (15 of the 19

hijackers were Saudi nationals). Enraged Saudi Arabia resorted to extortion by

threatening to liquidate its US bonds if the bill were to be passed.

Until now, no-one seemed to know for

sure how much of the US was "owned" by Saudi Arabia. Now the data is

public: a mere $117 billion. Significantly less than 10% of either China's 1.25

trillion and Japan's 1.13 trillion. In fact, Saudi Arabia doesn't even make it

the top 10 creditors. Lifting the shroud of secrecy is America's way of telling

Saudi Arabia publicly: "look, we don't have any reason to fear you. Because

you have no game."

SA unpopularity grows in the west

It's an intricate web of a complex story

but in layman terms - Saudi Arabia funded the Muslim brotherhood to impose

Sunni control over Middle East. When the Muslim brotherhood spun out of

control, the Saudis retracted and washed their hands off. The same happened in

Syria. Saudis funded the insurgent groups in Iraq and Syria including ISIS.

When ISIS got arrogant, the

Saudi regime withdrew into its shell again like a tortoise. Saudi Arabia funded

the war in Yemen which is still ongoing. Last year, unsurprisingly, Saudi

Arabia became the world's largest military spender at a time where western

weapon system increasingly fall in the hands of terrorist groups. The world has

slowly woken up to the fact that it was Saudi Arabia's insistence to fund

overthrow of Assad over the Qatar-Turkey pipeline to control oil to Europe that caused

the migrant crisis.

In a nutshell, the migrant crisis and

the surge in home-grown terror, routinely threatening European capitals, can be

attributed to Saudi ideological exports. As a result, Western democracies have

taken note of Saudi Arabia's agenda and now perceive Saudi Arabia in an

extremely negative light.

Of late, terror attacks in Paris and Orlando have awakened Western

democracies to the perils of Saudi Arabia's cultural export. After 40 years of

Wahhabist influence, fundamentalist Islam is alive and well, even standard on

European soil. As things go, since the fall of communism, fundamentalist Islam

exported by Saudi Arabia is unequivocally acknowledged as the number one threat

to western way of life.

Increasingly, with the string of

investigative reports, lot more people are aware of Saudi Arabia's role and

Saudi Arabia is being blamed for using oil revenues for destructive purposes.

Thankfully Europeans and Americans can elect their own leaders who value

transparency and reflect their own values. This is a central topic on the US

campaign trail as well as in Europe.

Saudi Arabia flinching

With drastic cuts in public spending,

Saudi Arabia is already feeling the pinch of falling oil prices.

Saudi Arabia has already spent 1/5 or $140B of cash reserves, since the oil

prices crashed, to maintain its heavily subsidized social system. The kingdom

needs the oil prices at $89 or higher to break even, whereas today it sells a

barrel of crude for exactly half that price. At the present rate the Kingdom

will become insolvent within 4 years.

It would be an understatement to say

that Saudi Arabia relies on high oil prices. Oil

accounts for about 92.5% of state revenue and represents 55% of GDP. This

problem is compounded by the fact that Saudi Arabia cannot levy taxes on its

citizenry for two reasons: first, tax payers universally demand the right to

vote on how money is spent. Voting implies choosing rulers and this is

unacceptable for a theocracy founded on writings unchanged since the 6th

century. Second, the Kingdom's workforce legendary low rate of productivity

renders it nearly unemployable, so much so that 93% of its private sector is

staffed by foreigners. So Saudi Arabia is left to auction off Saudi Aramco in

an attempt to attract foreign capital and delay the inevitable.

In addition, liquidating US assets may

be the only choice left for Saudi Arabia. If convicted of assisting terrorists

by an American court, the US can and will seize Saudi assets held in US

dollars. Which, it has to be pointed out, would abruptly accelerate the

timeline to default. Understandably, few financial institutions want to run the

risk of being associated with a rogue state on its way to bankruptcy.

Consequently Saudi Arabia's debt rating was cut to A2 by Moody's in May. This

is the second cut in a few months following S&P's cut to A+ .

The smart money is noticing that Saudi

Arabia is faltering and has no plan B to survive low oil prices. Not only

are politicians turning their backs on Saudi oil, so are financial

institutions.

What does it all mean for oil prices going forward?

Saudi Arabia's former might hinged on

the respect it received from OPEC members, which gave it control over OPEC

outputs - and de-facto control of 40% of world oil output, way more than its

share. Now that OPEC members have lost trust in Saudi Arabia, its leadership

has evaporated. We are transitioning to a time where open trading on world markets has

more impact on oil prices than

artificial supply control by OPEC.

Further, thanks to new advances in oil

production we can extract oil from unthinkable locations at competitive prices.

More importantly American ingenuity can do that on

short notice and on

such a massive scale that it turns the oil market on its head. Dependence on

Saudi crude is declining every day. Finally, Saudi Arabia has found its match.

If it thought that Iran was its rival, it has found a more portent one in the

West.

Sure oil prices plummeted to $26 and caused turmoil in the industry.

Yet, as usual, markets self-regulated and prices are now stabilizing at around

$50. In the long term, this is far more reliable than the old

"cartel-controlled" oil market because it is more transparent and

self-regulating.

Market dynamics function efficiently for

all other commodities (such as corn or steel) without a cartel to artificially

create scarcity. In essence, taking the OPEC cartel out of the picture

increases market efficiency. It is straightforward: the money that is no longer

retained by OPEC sheiks to buy Ferraris and ship Imams to the US and Europe is

instead allocated to productive endeavours such as funding medical research. It

makes the world a better place.

Let's face it. Many (if not most) Middle

Eastern rulers were either deposed or hand-picked with "assistance"

from western powers. Recently Egypt's democratically elected Muslim Brotherhood

was replaced by the Egyptian army, second largest recipient of US military aid

behind Israel. Saddam Hussein came to power with US assistance but was

overthrown in 2003 after planning to trade oil in Euros instead of dollars.

Iran's democratic government which intended to nationalize oil fields was

overthrown and replaced in 1953 with the Shah backed by the US and UK. Examples

galore. Each time a change of leadership took place it was because western

interests tied to oil were threatened by a ruling body which got a little too

bold.

It seems a page is about to be turned in

the history of the Kingdom, sometime between now and 2020. Given the strategic

importance of its (albeit overestimated) oil reserves, one needs to tread

carefully in order to avoid a replay of Iraq. In post-Saddam Iraq a leadership

vacuum caused fundamentalists to rise to power after a period of unrest, and

this should be shunned at all cost in favor of a smoother, more legitimate

transition. Thankfully more than 15,000 Saudi princes call the Kingdom home and

just as an oversupply of oil created a buyer's market, there is no shortage of

candidates to turn things around for the greater good.

based in Mali, haven't

taken the oil potential of Mali under consideration (think Canada, France) and

so their analysis have remained over Islam and insurgency, only-you need to

know.)

Predictably

a confrontation with the West over said resources and fundamental cultural

differences was bound to happen. This is likely the start of something bigger,

a new world paradigm where former colonial powers return not as oppressors but

as liberators and protectors of freedom and liberty.

No comments:

Post a Comment