Summary

Transocean's upcoming transaction with Borr Drilling sparked investors' interest.

Many assume that Seadrill's restructuring or bankruptcy will lead to multiple rig sales.

I explain why this will not be the case, both from the seller's and the buyer's side.

The only rigs that I expect to change hands in Seadrill restructuring are the newbuilds.

I noticed a common topic in all offshore drilling-related threads recently. Many investors seem to expect that the upcoming restructuring of Seadrill (NYSE:SDRL) will result in the sale of rigs at a bargain price. According to this narrative, Seadrill's peers will grab them at a fraction of their initial cost and prosper going forward. The goal of this article is to dispel this illusion.

Seadrill does not have to fire-sell rigs now

Everyone should keep in mind that entering bankruptcy proceedings through Chapter 11 does not lead to the liquidation of the company. The purpose of bankruptcy protection is to allow the business to survive and preserve jobs while stakeholders work on a viable survival plan and negotiate the appropriate capital structure. Therefore, if Seadrill ultimately files for Chapter 11, you should expect that it will continue operating as usual while creditors battle in court for their stakes.

Sometimes, a company still ends being liquidated. The instructive case is the fate of Hercules Offshore, which owned a fleet of mostly older jack-ups. The company filed for bankruptcy due to lack of backlog and significant debt load, then emerged from bankruptcy only to find itself painted in the corner by the most severe offshore drilling market downturn in history. As a result, Hercules Offshore had to liquidate itself to save what's left of value for its stakeholders.

You should keep in mind that Hercules Offshore's case is unique because the company had a weak business position even without the debt problems. The fleet was too old, job opportunities were scarce and that was the main reason why the company had to liquidate itself a year after it emerged from the original bankruptcy. This case does not resemble the Seadrill's case as Seadrill will be a major strong player if it gets rid of debt.

In order to continue as a viable enterprise, Seadrill has to decrease its debt and deal with newbuild obligations. Current rig valuations as judged by the few sales do not justify selling rigs to deal with debt even if such a sale was possible. The truth is that there are few buyers in the market so a sale is hardly an option. The only right way to go is the debt-to-equity swap, which will significantly decrease Seadrill's indebtedness and allow the company to weather the current storm.

Prospective buyers

Let's look at potential buyers to evaluate the thesis that Seadrill is not about to fire-sell its rigs.

Two Hercules Offshore jack-ups were bought by Borr Drilling, which went on to sign a letter of intent with Transocean (NYSE:RIG) to buy 15 jack-ups. It looks like Borr's transaction with Hercules Offshore created an illusion of upcoming sales from drillers which have ongoing restructuring talks. As a reminder, Pacific Drilling (NYSE:PACD) and Ocean Rig (NASDAQ:ORIG) are currently in restructuring talks with their creditors.

The potential candidates for distressed asset purchases include the "survival group" - Diamond Offshore Drilling (NYSE:DO), Rowan (NYSE:RDC), Ensco (NYSE:ESV), Noble Corp. (NYSE:NE) and the abovementioned Transocean. Newcomers like Borr Drilling and John Fredriksen's Northern Drilling should also considered as potential acquirers of distressed assets.

Let's go through these buyers one by one. Diamond Offshore is the most conservative driller in this group. Its management team was the most bearish on the industry and the company immediately cold-stacked rigs that lost work. As a result, the company has no warm stacked rigs at all. A company with this strategy won't buy additional rigs without work as it will have to immediately stack them. Also, Diamond Offshore is a floater-focused driller, and floater segment has yet to see any sign of activity, even at minimal dayrates. Purchasing floaters now looks like a pure gamble and it is evident that Diamond Offshore's management are not gamblers.

Rowan is probably the best positioned to be a distressed asset buyer. However, the company has already committed to a joint venture with Saudi Aramco, so it is not clear whether Rowan management will decided to shop for more rigs. My bet is that any additional shopping for Rowan will be on the floater side, but the timing is uncertain.

Ensco has plenty of stacked rigs. The company has recently arranged a deal to delay the delivery of a drillship. It does not look like after such a move the company will be searching to purchase more rigs.

Noble Corp. is the only driller that keeps updating its fleet status report on a monthly basis, and the latest update was grim. The work is really scarce and everything that Noble Corp. was able to find was a two-month job for a jack-up. I do not believe that Noble Corp. is positioned to commit to more rigs at this point and I expect that the company will be in a defensive mode until there is any certainty about the timing of the recovery.

Transocean has just committed to sell the entire jack-up fleet (existing ones and newbuilds) to Borr Drilling (I discussed implications of the sale in this article). So, if any buys should be expected, they'll be on the floater side. However, the company has many stacked floaters. It will be a huge success if all those floaters will survive the current downturn. In my view, Transocean is positioned to sell/scrap more rigs rather than buy new ones.

Borr Drilling was able to use the equity market to purchase rigs, but there are limits to everything and after the transaction with Transocean the company will have plenty of rigs waiting for work. In addition, Borr Drilling was founded by former Seadrill executives, so I guess that any transactions with Seadrill are highly unlikely due to ego-related reasons.

The remaining prospective buyer is Northern Drilling which is developed by Seadrill's founder, John Fredriksen. I think that it can be used to deal with Seadrill newbuilds.

Newbuilds

Here's a list of Seadrill newbuild rigs:

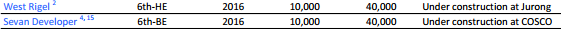

Semi-subs

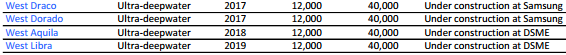

Drillships

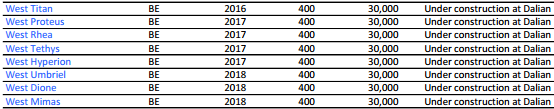

Jack-ups

Newbuilds are an additional headache for Seadrill. Obviously, the company can't take delivery without a contract in place. At the same time, yards are getting inpatient as highlighted by Ensco's drillship case and demand additional contributions to delay deliveries. In Seadrill's case, there are just too many rigs ordered. I don't think that any player in the market has the capacity to absorb them even at a discount.

In my view, the problem will be solved like in West Rigel's case. As a reminder, West Rigel is supposed to be owned by the joint venture between North Atlantic Drilling (NYSE:NADL) and the yard, Jurong, if no contract for the rig is found. This is an elegant exit from the troublesome situation which can be replicated en masse if Northern Drilling buys stakes at Seadrill's newbuilds. Compared to existing rigs, on which creditors count as a collateral, every stakeholder in Seadrill restructuring will be glad to see newbuilds vanish from the company's pipeline without additional costs.

Bottom line

There's no reason to expect a fire-sale of Seadrill rigs if the company enters Chapter 11. In addition, there are likely no buyers for a big fleet, and single sales won't move the needle for the company. The exception are the newbuild rigs, which could be acquired by a new speculative buyer like John Fredriksen's Northern Drilling and also could be partially owned by shipyards. As we see from recent developments, consolidation does not happen as existing players have no resources to participate in distressed sales. New players emerge, making the market even more competitive.

Disclosure: I am/we are long DO.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I may trade any of the abovementioned stocks.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks

No comments:

Post a Comment